What is the future of the Las Vegas housing market? If someone buys a home for $100k, wouldn?t he/she be able to buy it for $90K next year? This question was asked from a blue ribbon panel, including Laurie Anne Maggiano of Department of Treasury and no one could answer. Guess what? I am just fearless and hopefully good enough to attempt to answer it.

Las Vegas real estate july-2012: Confusion is the new story of Las Vegas real estate market (housing market) as drastic price hikes continue due to lack of inventory and Las Vegas real estate investors willing to live with lower cash flow in hopes of greater future appreciation.

1: What happened to thousands of foreclosure homes that were listed and sold through Las Vegas MLS? Poof, gone, man this is magic J

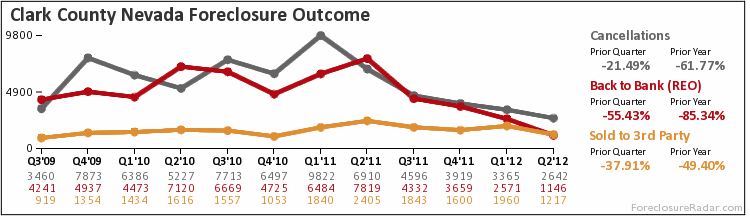

I want to show the chart of foreclosure outcomes for Clark County Nevada which includes Las Vegas, North Las Vegas, and Henderson, Nevada.

?Please click on the chart to see it better

Chart for outcomes of Las Vegas trustee sale auction, cancellations, foreclosures sold back to the bank and foreclosures that were purchased by the third party

?

?

?

?

?

?

?

By Nevada law a property that is going to get foreclosed on must be auctioned off in the Trustee sale auction and lenders can NOT bid more than the loan amount which is not much of an issue here. However they can set a reserve price, which again can?t be more than the loan amount. The auction can have two outcomes other than being postponed or cancelled. Either a third party meets the minimum set by the lender and wins the property, or it will go back to the bank and becomes a bank owned or REO and then is retailed through Las Vegas Realtor?s MLS or sold in a public auction.

As you can see the number of properties (not just single family homes) which have sold back to the banks in the Nevada Trustee Sale Auction has drastically shrunk.

In the first 2 quarters of 2011, banks took back 14,303 properties (not just homes), while only 3,717 properties where taken back by the banks in the last two quarters of 2012. The difference is 10,560 homes which will not be selling through the Las Vegas MLS or be auctioned off. That is why bank owned homes listed in the Las Vegas MLS have shrunk to less than 400 homes in June and July, 2012.

Another important point is that for the first time since the foreclosure crisis third party buyers have bought more homes at the Las Vegas trustee sale auction than banks have taken back. This is due to the fact that some very big home buying outfits are paying very high for prices for these homes since they do not want to deal with counter offers, bank addendums and short sale headaches resulting from buying through the MLS and they can spread the risk.

I will continue this discussion later.

hungergames bagpipes aspirin aspirin 21 jump street illinois primary results acapulco mexico

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.